developersjp.ru Overview

Overview

What Is The Standard Federal Tax Deduction

Standard Deduction The Tax Cuts and Jobs Act (TCJA) increased the standard deduction How does the federal income tax deduction for state and local taxes work? The standard deduction is a predetermined amount that reduces your taxable income, lowering the income subject to tax. In most cases, whether to take the. The standard deduction reduces a taxpayer's taxable income by a set amount determined by the government. It was nearly doubled in The standard deduction is a fixed dollar amount that reduces the portion of your income on that you're taxed. It allows taxpayers to reduce their taxable. The rule reduced the value of a taxpayer's itemized deductions by 3% of adjusted gross income (AGI) over a certain threshold. The 3% reduction continued until. It accounts for otherwise deductible personal expenses such as medical expenses, home mortgage interest and property taxes, and charitable contributions. You. A tax deduction is a provision that reduces taxable income. A standard deduction is a single deduction at a fixed amount. Itemized deductions are popular. Federal Individual Income Tax Brackets, Standard Deduction, and Personal Exemption. Congressional Research Service. Limitation on Itemized Deductions. In short, a deduction is an amount you can subtract from your taxable income to reduce the overall amount subject to taxation. When filing your taxes, there are. Standard Deduction The Tax Cuts and Jobs Act (TCJA) increased the standard deduction How does the federal income tax deduction for state and local taxes work? The standard deduction is a predetermined amount that reduces your taxable income, lowering the income subject to tax. In most cases, whether to take the. The standard deduction reduces a taxpayer's taxable income by a set amount determined by the government. It was nearly doubled in The standard deduction is a fixed dollar amount that reduces the portion of your income on that you're taxed. It allows taxpayers to reduce their taxable. The rule reduced the value of a taxpayer's itemized deductions by 3% of adjusted gross income (AGI) over a certain threshold. The 3% reduction continued until. It accounts for otherwise deductible personal expenses such as medical expenses, home mortgage interest and property taxes, and charitable contributions. You. A tax deduction is a provision that reduces taxable income. A standard deduction is a single deduction at a fixed amount. Itemized deductions are popular. Federal Individual Income Tax Brackets, Standard Deduction, and Personal Exemption. Congressional Research Service. Limitation on Itemized Deductions. In short, a deduction is an amount you can subtract from your taxable income to reduce the overall amount subject to taxation. When filing your taxes, there are.

NC Standard Deduction ; Single, $12, ; Married Filing Jointly/Qualifying Widow(er)/Surviving Spouse, $25, ; Married Filing Separately ; Spouse does not claim. A tax deduction is an amount that the IRS allows taxpayers to deduct from their taxable income, thus reducing the tax that they owe. Taxpayers can either. $ for single and head of household taxpayers. $1, for married taxpayers filing a joint return. New Individual and Corporate Nonrefundable Tax Credits. Personal Income Tax. IRA deduction · Student loan interest deduction · Moving expenses ; Pennsylvania Personal Income Tax. Standard deduction · Medical and dental. Section 63(c)(2) provides the standard deduction for use in filing individual income tax returns. See all standard deductions by year and legislative. The standard deduction is increased to $27, for married individuals filing a joint return; $20, for head-of-household filers; and $13, for all. TaxAct® will use the higher of your itemized deductions or the standard deduction for your filing status to maximize your tax benefit. Refer to IRS. What are standard deductions? · $12, for single or married filing separate filers · $19, for head of household filers · $25, for married filing jointly. N/A – Connecticut does not have a standard or itemized deduction. Instead, it starts with the federal AGI, since the deductions have already been taken out. N/A. It simplifies tax filing, using a specific amount set by the IRS that is deducted from your taxable income according to your filing status. The standard. Standard Deductions ; ; Filing Status. Standard Deduction ; Unmarried Individuals. $12, ; Married Individuals Filing Separate Returns. $12, ; Heads of. Medical and dental expenses. Great! · Taxes you paid. You've likely already paid some taxes, such as real estate tax (if you're a homeowner), state income tax . The basic standard deduction for is USD 29, for married couples filing a joint return, USD 14, for individuals, and USD 21, for heads of household. Michigan Standard Deduction · $20, for a single or married filing separate return, or · $40, for a married filing joint return · These amounts may have. Standard Deduction and Itemized Deduction. As with federal income tax returns, the state of Arizona offers various credits to taxpayers. If you are married filing jointly and you OR your spouse is 65 or older, your standard deduction increases by $1, If BOTH you and your spouse are 65 or. For Married Filing Joint or Combined returns, the $4, standard deduction amount or the itemized deduction amount may be divided between the spouses in any. The standard deduction was added to U.S. tax law by the Tax Cuts and Jobs Act to replace the personal exemption on individual income tax returns. The amount of the deduction is the lesser of $5, or the actual amount paid by the taxpayer. If filing a joint return, the deduction is limited to $10, or. Standard Deduction - The tax year standard deduction is a You may take the federal standard deduction, while this may reduce your federal tax.

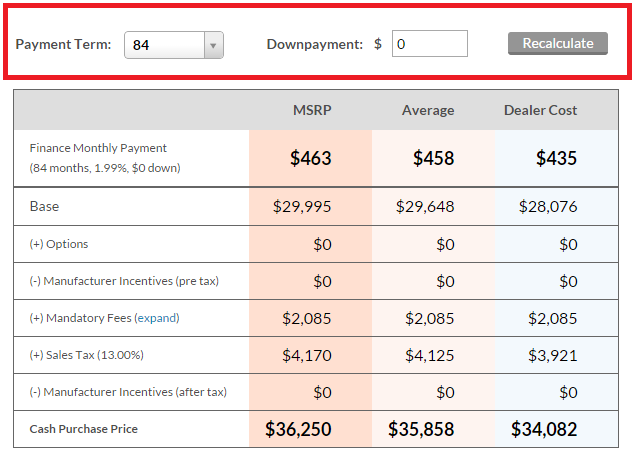

What Is A Typical Monthly Car Payment

In Q1 , the average interest rate for a new car was % and % for a used car, according to Experian. When it comes to auto loans, most lenders use. The average car payment for a new vehicle is $ monthly, according to first-quarter data from Experian — up % year over year. Average monthly car payment in US is over $!!! How the bleep do people do that? An old car with high mileage is gonna cost me at least $/. Use our car payment calculator to determine what your monthly car payments will be With the average price of a new vehicle sitting above $35, and. The average monthly automobile payment in the United States is $ for a new car. · $ is the typical monthly automobile payment in the United States for a. A Car Payment Calculator that helps you determine your monthly payment and the time it would take you to pay off your debt. Top Auto Loan Statistics In The United States (): · The average monthly automobile payment in the United States is $ for a new car. · $ is the typical. The average car payment in Q3 reached a record high of $ per month for new cars, up % since Q3 , and a 32% increase from Your average monthly car payment can affect your financial health. Learn how your down payment, interest rate and credit can change and impact your payment. In Q1 , the average interest rate for a new car was % and % for a used car, according to Experian. When it comes to auto loans, most lenders use. The average car payment for a new vehicle is $ monthly, according to first-quarter data from Experian — up % year over year. Average monthly car payment in US is over $!!! How the bleep do people do that? An old car with high mileage is gonna cost me at least $/. Use our car payment calculator to determine what your monthly car payments will be With the average price of a new vehicle sitting above $35, and. The average monthly automobile payment in the United States is $ for a new car. · $ is the typical monthly automobile payment in the United States for a. A Car Payment Calculator that helps you determine your monthly payment and the time it would take you to pay off your debt. Top Auto Loan Statistics In The United States (): · The average monthly automobile payment in the United States is $ for a new car. · $ is the typical. The average car payment in Q3 reached a record high of $ per month for new cars, up % since Q3 , and a 32% increase from Your average monthly car payment can affect your financial health. Learn how your down payment, interest rate and credit can change and impact your payment.

Although you lower the monthly payment by $ with the eight-year term versus the five-year ($$), you pay $2, more in total interest ($. A down payment on a vehicle is a certain percentage of the total cost of the car that you pay upfront. Down payments are often anywhere from a minimum of 10%. As of the first quarter of , new vehicle owners paid an average of $ a month on their vehicles, while used car owners paid $ An old car with high milage should cost you less than $ a month. I guess it depends on your perception of old and what you consider high. If only the monthly payment for any auto loan is given, use the Monthly typical going rates in mind to enable effective negotiations with a car salesman. Your average monthly car payment can affect your financial health. Learn how your down payment, interest rate and credit can change and impact your payment. Monthly Vehicle Payment Calculator · Estimated Monthly Payment · Your next vehicle is waiting for you. · Additional auto resources. Estimate your monthly payments with developersjp.ru's car loan calculator and see how factors like loan term, down payment and interest rate affect payments. Calculate your estimated monthly car payments using this free online calculator. Calculating your monthly car loan payment makes it easier to weigh competing loan offers. Lenders typically require you to carry comprehensive and. The average car payment in Q3 reached a record high of $ per month for new cars, up % since Q3 , and a 32% increase from A lower monthly payment on your car loan doesn't always mean you're saving money. Here's how car loans work. Purchasing a car typically means taking out a car. Quick Facts About Car Down Payments · Plan on a down payment of at least 20% of the total. · The more money you put down, the more you'll save in interest charges. car when trying to lower the monthly payment with a longer length car loan. Average Monthly Operating Cost. Yearly Salary (Post-Tax), $43, 5-Year Loan. Down Payment ($). Cash Rebate ($). Trade-In Value ($). Estimated Monthly Payment. $ Principal: $; Interest. New Car Loan Rates. 36 month, %. Use Carvana's auto loan calculator to estimate your monthly payments. See how interest rate, down payment & loan term will impact your monthly payments. Average interest rates for car loans The average APR on a new-car loan with a month term was % in the first quarter of , according to the Federal. auto loan per month, the less interest you will pay over time. A monthly payment calculator will typically estimate your car payment using simple interest. Typical Car Loan Lengths. The most common lengths of car You may need to make a larger down payment to keep monthly payments at a reasonable level. Basil Family Dealerships make it easy to put a new car in your driveway, while eliminating much of the fuss of the typical car buying process.

Delivery That Takes Cash

Yes, we do allow customers to pay with cash but it depends on the restaurant and if they're willing to accept cash payments. DoorDash offers grocery and alcohol deliveries in select areas and has a significant market share in the U.S. They accept cash payments for most partnered. Yes, we do allow customers to pay with cash but it depends on the restaurant and if they're willing to accept cash payments. Serving Families Since Order Online For Dine-In Or Delivery! Fast Delivery. Free Online Ordering. Home of the Legendary Crispy, Curly Pepperoni. Top 10 Best Cash Delivery Food Near New York, New York · 1. Joe's Pizza · 2. Golden Diner · 3. Los Tacos No. 1 · 4. Blue Willow 夜来湘 · 5. Peppa's Jerk Chicken. Yes, DoorDash does offer a “Cash on Delivery” option, but it is limited to certain merchants and areas. This option allows customers to pay with cash at the. DoorDash, Uber Eats, Grubhub, EatStreet, and Seamless are some of the food delivery services that offer cash payment options, depending on the specific. Which restaurants in Chicago accept cash for delivery orders? · Chicago Restaurant Cleared Out for Kamala · How Much Is Cheesecake Factory for 2 in Chicago. Top 10 Best Cash Delivery in Edmonton, AB - August - Yelp - KFC, McDonald's, All Happy Family Restaurant, Miss Saigon, Grandma Pizza, DOSC. Yes, we do allow customers to pay with cash but it depends on the restaurant and if they're willing to accept cash payments. DoorDash offers grocery and alcohol deliveries in select areas and has a significant market share in the U.S. They accept cash payments for most partnered. Yes, we do allow customers to pay with cash but it depends on the restaurant and if they're willing to accept cash payments. Serving Families Since Order Online For Dine-In Or Delivery! Fast Delivery. Free Online Ordering. Home of the Legendary Crispy, Curly Pepperoni. Top 10 Best Cash Delivery Food Near New York, New York · 1. Joe's Pizza · 2. Golden Diner · 3. Los Tacos No. 1 · 4. Blue Willow 夜来湘 · 5. Peppa's Jerk Chicken. Yes, DoorDash does offer a “Cash on Delivery” option, but it is limited to certain merchants and areas. This option allows customers to pay with cash at the. DoorDash, Uber Eats, Grubhub, EatStreet, and Seamless are some of the food delivery services that offer cash payment options, depending on the specific. Which restaurants in Chicago accept cash for delivery orders? · Chicago Restaurant Cleared Out for Kamala · How Much Is Cheesecake Factory for 2 in Chicago. Top 10 Best Cash Delivery in Edmonton, AB - August - Yelp - KFC, McDonald's, All Happy Family Restaurant, Miss Saigon, Grandma Pizza, DOSC.

Uber Eats is now allowing people to pay for their orders in cash upon delivery. That means you may be receiving cash, making change, and getting your earnings. Get food delivery to your doorstep from thousands of amazing local and national restaurants. Find the meal you crave and order food from restaurants easily. Enter your location to find delivery partners near you. Enter Zip/City take that as a valid request to opt-out. Therefore we would not be able to. Sellers with the checkout permission to take payments. Set permissions in Square Dashboard. About accepting cash, checks, and other tender. To keep your. The food delivery services that accept cash include DoorDash, GrubHub, Uber Eats, developersjp.ru, Seamless, and EatStreet. In addition, you. Uber Eats users are now able to pay for their orders in cash. This means that you may be accepting cash on delivery, providing change as necessary. Your store should still be accepting cash for deliveries. Delivery experts are expected to take several precautions that include washing their hands before and. Cash on delivery (COD) is when a recipient pays for a good or service at the time of delivery. · A COD transaction can take several forms, each affecting a. Information · Recipient may pay by cash, pin-based debit card, or a personal check or money order made payable to the sender. (Sender may not specify payment. Cash Wise Liquor same-day delivery or curbside pickup in as fast as 1 hour with Instacart. Your first delivery or pickup order is free! When in doubt, go for takeout—Grubhub has it all! Order food delivery from thousands of restaurants, including local spots and national chains. cash credit What on earth am I supposed to do with that? That doesn't even cover the service/delivery fees. I kept giving them the benefit of the doubt. Instacart sometimes runs promotions that allow you to earn extra cash, and delivery drivers also keep % of customer tips. It's important to note that Uber. We do not currently accept personal checks. Drivers do not carry change, you must have the exact amount of cash for placing a cash order. If you do not have the. How long will it take for my food to arrive? The delivery time depends on mutliple factors, but an estimated time of arrival will be provided to you inside the. There is a new feature in your Deliveroo Rider app: orders can be paid in cash by customers. During this kind of delivery you should pay the restaurant in. Select your order type, pickup, delivery, continue, Five Guys on Google Play, Five Guys on the App Store. Like free Delivery from Club on eligible $50 orders, free Curbside Pickup & 2% Sam's Cash in club. Upgrade to Plus. Frequently Asked Questions. How does. Order online to get food delivered to your home or office fast! One of our nearby drivers will immediately be contacted and pick up your order as soon as the. Your store should still be accepting cash for deliveries. Delivery experts are expected to take several precautions that include washing their hands before and.

401k Withdrawal To Pay Taxes

All Fields Required *Distributions from your QRP are taxed as ordinary income and may be subject to an IRS 10% additional tax if taken prior to age 59 1/2. Yes, your withdrawal will be taxed at your marginal tax bracket rate. Unless of course you withdraw before you reach 59 1/2, in which case add. You must pay income tax on any previously untaxed money you receive as a hardship distribution. You may also have to pay an additional 10% tax, unless you're. Yes—your (k) withdrawal is subject to federal income tax. (The income tax Depending on the amount you withdraw and where you live, you may need to pay. However, when you take an early withdrawal from a (k), you could lose a significant portion of your retirement money right from the start. Income taxes, a You'll pay income taxes when making a hardship withdrawal and potentially the 10% early withdrawal fee if you withdraw before age 59½. However, the 10% penalty. For early withdrawals that do not meet a qualified exemption, there is a 10% penalty. You will also have to pay income tax on those funds. Both calculations are. Although you generally have up to five years to repay a (k) loan, leaving your job (or losing it) before the loan is repaid may mean you have to pay back. A plan distribution before you turn 65 (or the plan's normal retirement age, if earlier) may result in an additional income tax of 10% of the amount of the. All Fields Required *Distributions from your QRP are taxed as ordinary income and may be subject to an IRS 10% additional tax if taken prior to age 59 1/2. Yes, your withdrawal will be taxed at your marginal tax bracket rate. Unless of course you withdraw before you reach 59 1/2, in which case add. You must pay income tax on any previously untaxed money you receive as a hardship distribution. You may also have to pay an additional 10% tax, unless you're. Yes—your (k) withdrawal is subject to federal income tax. (The income tax Depending on the amount you withdraw and where you live, you may need to pay. However, when you take an early withdrawal from a (k), you could lose a significant portion of your retirement money right from the start. Income taxes, a You'll pay income taxes when making a hardship withdrawal and potentially the 10% early withdrawal fee if you withdraw before age 59½. However, the 10% penalty. For early withdrawals that do not meet a qualified exemption, there is a 10% penalty. You will also have to pay income tax on those funds. Both calculations are. Although you generally have up to five years to repay a (k) loan, leaving your job (or losing it) before the loan is repaid may mean you have to pay back. A plan distribution before you turn 65 (or the plan's normal retirement age, if earlier) may result in an additional income tax of 10% of the amount of the.

Any withdrawals prior to 59 1/2 from your (k) will be taxable and be subject to a 10% early withdrawal penalty. You can expect 20% of an early (k) withdrawal to be withheld for taxes. In the case of a year-old paying a 24% tax rate who withdraws $10,, some funds. When you make a withdrawal from a (k) account, the amount of tax you pay depends on your tax bracket in the year when the withdrawal is made. For example, if. Taxes on Pension Income You have to pay income tax on your pension and on withdrawals from any tax-deferred investments—such as traditional IRAs, (k)s, A withdrawal permanently removes money from your retirement savings for your immediate use, but you'll have to pay extra taxes and possible penalties. Let's. You can rollover your k(k) into an IRA or a new employer's (k) without having to pay income taxes on the money in your (k). If your k contributions were traditional personal deferrals the answer is yes you will pay income tax on your withdrawals. If you take withdrawals before. Although you generally have up to five years to repay a (k) loan, leaving your job (or losing it) before the loan is repaid may mean you have to pay back. You will almost always be required to pay some income taxes on any withdrawal from your (k) account, regardless of the reason for the withdrawal. Unfortunately, there's usually a 10% penalty—on top of the taxes you owe—when you withdraw money early. This is where the rule of 55 comes in. If you turn 55 . Withdrawals from a (k) plan may result in several types of tax, and you need to understand all of them. So your savings are tax deferred, but not tax free (sorry), which means you still have to pay Uncle Sam his due, no matter when you withdraw the money. Penalty. So your savings are tax deferred, but not tax free (sorry), which means you still have to pay Uncle Sam his due, no matter when you withdraw the money. Penalty. Other options that you can use to avoid paying taxes include taking a (k) loan instead of a (k) withdrawal, donating to charity, or making Roth. If your (k) contributions were traditional personal deferrals, the answer is yes; you will pay income tax on your withdrawals. If you take withdrawals before. Basically, any amount you withdraw from your (k) account has taxes withheld at 20%, and if you're under age 59½, you'll be taxed an additional 10% when you. Typically, you have to repay money you've borrowed from your (k) within five years by making regular payments of principal and interest at least quarterly. You usually put money into a tax-deferred savings plan to save for your future retirement. If you withdraw money from your plan before age 59 1/2, you might. If you withdraw from an IRA or (k) before age 59½, you'll be subject to an early withdrawal penalty of 10% and taxed at ordinary income tax rates. There are. Taxes matter: How different accounts are taxed · Withdrawals are generally subject to ordinary income tax rates, which can get progressively higher the more you.

Is It Good To Close Credit Card

Canceling a credit card leaves you with less available credit overall. Having an available line of credit, or a high credit limit, is good for your credit score. Canceling an unused credit card can lower the total amount of your available credit. This may lower your credit utilization ratio, which is one of the major. I believe it is typically recommended to hold it until just after the 1 year mark, then cancel. Many lenders would refund the annual fee. The worst is when a creditor closes a credit card on us right before we are applying for a mortgage, causing our score to plummet. When balance to limit ratio's. Closing your cards will shorten the length of your credit history, which may result in a lower score. To prevent this from happening, it may be wiser to spend. Downgrading to a card with a lower interest rate and no annual fee may be a better option. Is it better to cancel unused credit cards or keep them? If the. Closing a credit card could lower the amount of overall credit you have versus the amount of credit you're using (your debt to credit utilization ratio), which. When Closing a Credit Card Makes Sense · You always pay your credit card balance. If you never carry any credit card debt over month to month, your credit score. Should I close credit cards I don't use? · 1. Could help maintain your credit utilization ratio: · 2. Improves the average age of your credit: · 3. Preserve low-. Canceling a credit card leaves you with less available credit overall. Having an available line of credit, or a high credit limit, is good for your credit score. Canceling an unused credit card can lower the total amount of your available credit. This may lower your credit utilization ratio, which is one of the major. I believe it is typically recommended to hold it until just after the 1 year mark, then cancel. Many lenders would refund the annual fee. The worst is when a creditor closes a credit card on us right before we are applying for a mortgage, causing our score to plummet. When balance to limit ratio's. Closing your cards will shorten the length of your credit history, which may result in a lower score. To prevent this from happening, it may be wiser to spend. Downgrading to a card with a lower interest rate and no annual fee may be a better option. Is it better to cancel unused credit cards or keep them? If the. Closing a credit card could lower the amount of overall credit you have versus the amount of credit you're using (your debt to credit utilization ratio), which. When Closing a Credit Card Makes Sense · You always pay your credit card balance. If you never carry any credit card debt over month to month, your credit score. Should I close credit cards I don't use? · 1. Could help maintain your credit utilization ratio: · 2. Improves the average age of your credit: · 3. Preserve low-.

Is it better to cancel unused credit cards or keep them? By leaving an old credit card open, while using it responsibly, you can maximize its positive effect. How to Cancel a Credit Card. 1. Redeem any unused rewards. 2. Make sure there is no unpaid balance. 3. Call your credit card company. 4. Enter your card number. If you decide not to ask that the card be reinstated, it's a good idea to check your credit report to make sure the card account shows as closed. You're. If you want to cancel a card, make a plan to pay off the balance. And then cancel the card. Confirm the credit card cancellation in writing. When you cancel a. Experts often warn against closing a credit card, especially your oldest one, since it can have a negative impact on your credit score. Closing an account can dramatically reduce your line of credit and thus, lower your credit score. If you've got a good credit score already, you'll probably be. Closed credit accounts stay on your credit report for up to 10 years. If you had missed payments on the account before it was closed, those missteps remain on. Your credit score plays an important role in determining your eligibility for credit, and closing a credit card does have the potential to lower your score. credit card, you may benefit by closing it. This will help you save money and ultimately preserve your credit score. Until you've established new or better. If you'll close the credit card, total credit limit assigned to you will decrease & ultimately it will affect your credit utilization ratio. So. We've written frequently about how closing accounts isn't necessarily good for your credit score, but once an account is closed it can't be used to accumulate. Yes, closing the card in discussion will hurt your credit score. The age of your revolving credit comprises about 35% of your score. You have an. Call the card issuer to officially close the account. While it's possible to cancel some credit cards online, it's a better idea to call your card issuer. This. However, properly closing a credit card does not automatically damage your credit. High interest rates, yearly fees, and too much temptation to use a paid off. Closing a new account will have less of an impact. To keep your credit score in good standing, it's important to remember to stick with a low balance that can. You can dispute any inaccuracies, such as the implication of default when a credit card company closed an account that was current and in good standing. You. When you think about the costs of using your credit cards, you might decide you're better off canceling most of them. In fact, one way to manage high credit. Closing a credit card will affect your credit score. And while a lower credit score can make it more difficult to qualify for loans, it may be the right. Is it bad to close a credit card? Closing an account isn't necessarily bad, but it can impact your credit score in a negative way. This is mainly due to the.

How Much Would My Home Loan Be

Use SmartAsset's free mortgage calculator to estimate your monthly mortgage payments, including PMI, homeowners insurance, taxes, interest and more. Calculate your monthly home loan payments, estimate how much interest you'll pay over time, and understand the cost of your mortgage insurance, taxes. Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. Use our free mortgage calculator to find out how much you'll be paying monthly on your home mortgage, including taxes, insurance, PMI and closing costs. Results in no way indicate approval or financing of a mortgage loan. Contact a mortgage lender to understand your personalized financing options. Explore. To Decide How Much Home You Can Afford Our mortgage calculator can help you determine an affordable home price for you, taking into account your other debts . Use Zillow's home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes, home. If you qualify for a VA loan, you may not have to put any money down, although you will be responsible for closing costs. How is my interest rate determined? Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Loan amount. Interest rate. Use SmartAsset's free mortgage calculator to estimate your monthly mortgage payments, including PMI, homeowners insurance, taxes, interest and more. Calculate your monthly home loan payments, estimate how much interest you'll pay over time, and understand the cost of your mortgage insurance, taxes. Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. Use our free mortgage calculator to find out how much you'll be paying monthly on your home mortgage, including taxes, insurance, PMI and closing costs. Results in no way indicate approval or financing of a mortgage loan. Contact a mortgage lender to understand your personalized financing options. Explore. To Decide How Much Home You Can Afford Our mortgage calculator can help you determine an affordable home price for you, taking into account your other debts . Use Zillow's home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes, home. If you qualify for a VA loan, you may not have to put any money down, although you will be responsible for closing costs. How is my interest rate determined? Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Loan amount. Interest rate.

The most significant factor affecting your monthly mortgage payment is the interest rate. If you buy a home with a loan for $, at percent your. How do mortgage lenders determine how much home you can afford? When you apply for a mortgage to buy a home, lenders will closely review your finances, asking. In just minutes, you can find out how much you could borrow and receive a customized mortgage estimate — all without affecting your credit score. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. The loan amount, the interest rate, and the term of the mortgage have a dramatic effect on the total amount you will pay for your home. Additionally. Use Zillow's affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment and. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. Mortgage calculator · Average interest rate · How much will my mortgage repayments be? · How much can I borrow? · How can I repay my loan sooner? · Disclaimers. Use this mortgage calculator to estimate how much house you can afford. See your total mortgage payment including taxes, insurance, and PMI. Estimate your monthly mortgage payments with taxes and insurance by using our free mortgage payment calculator from U.S. Bank. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. your gross monthly income on home-related costs and 36% on total debts, including your mortgage, credit cards and other loans like auto and student loans. Understand how much house you can afford. This mortgage affordability calculator provides an idea of your target purchase price, and it's based on some. Use Investopedia's mortgage calculator to see how different inputs for the home price, down payment, loan terms, and interest rate would change your monthly. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. To estimate your monthly mortgage payment, simply input the purchase price of the home, the down payment, interest rate and loan term. If you'd like a more. Assess your financial readiness to buy a home. Housing Expense Ratio Calculator. Determine how much of your monthly income goes into your monthly mortgage. For example, if your interest rate is 3%, then the monthly rate will look like this: /12 = n = the number of payments over the lifetime of the loan. Use Investopedia's mortgage calculator to see how different inputs for the home price, down payment, loan terms, and interest rate would change your monthly.

Is There A Bank Near Me

Find a Citizens bank branch near you. Book an appointment for help with all of your financial questions from opening a checking account, home lending. Committed to the financial health of our customers and communities. Explore bank accounts, loans, mortgages, investing, credit cards & banking services». Find the nearest PNC Bank branch location, solution center, ATM or partner ATM to you. Check lobby and drive-thru hours and get contact information. Welcome to Commerce Bank financial center & ATM location finder. We offer personal & business banking, checking, loans, credit cards & more. Find a nearby. Find the nearest branch or ATM for hours and directions. Get in touch with one of our mortgage lenders, financial advisors, or wealth managers. FACT: Withdrawing cash from a foreign ATM often saves you money versus exchanging currency in your home country. Other fees may apply from your bank and ATM. TD has hundreds of ATM and branch locations across US. Use our branch locator tool to conveniently find the branch or ATM near you. Use our locator to find an ATM or branch near you or browse all locations. any federal government agency • no bank guarantee • may lose value. Business. Find a U.S. Bank ATM or Branch near you to open a bank account, apply for loan, deposit funds & more. Get hours, directions & financial services provided. Find a Citizens bank branch near you. Book an appointment for help with all of your financial questions from opening a checking account, home lending. Committed to the financial health of our customers and communities. Explore bank accounts, loans, mortgages, investing, credit cards & banking services». Find the nearest PNC Bank branch location, solution center, ATM or partner ATM to you. Check lobby and drive-thru hours and get contact information. Welcome to Commerce Bank financial center & ATM location finder. We offer personal & business banking, checking, loans, credit cards & more. Find a nearby. Find the nearest branch or ATM for hours and directions. Get in touch with one of our mortgage lenders, financial advisors, or wealth managers. FACT: Withdrawing cash from a foreign ATM often saves you money versus exchanging currency in your home country. Other fees may apply from your bank and ATM. TD has hundreds of ATM and branch locations across US. Use our branch locator tool to conveniently find the branch or ATM near you. Use our locator to find an ATM or branch near you or browse all locations. any federal government agency • no bank guarantee • may lose value. Business. Find a U.S. Bank ATM or Branch near you to open a bank account, apply for loan, deposit funds & more. Get hours, directions & financial services provided.

near you. Find a Truist the use of my sensitive personal information, opens in new tab · Fraud & security · Terms and conditions. Footer Navigation. Banking. Search M&T Bank branch locations and ATMs. Easily manage your finances when you open a savings account or checking account at M&T Bank. Browse all First Citizens Bank branch and ATM locations near you. Visit one of our + locations for personal and business banking, credit cards, or loans. Banks Near Me. New York, NY. Top 10 Best Banks Near New York, New York. Related "When our own big bank (of the USA) cancelled a notary appointment. Find Huntington Bank ATM and branch locations near me, including hours and directions. close to where their student will be living while at NYU. Most major banks Also, a bank in the student's hometown and in the New York City area. Use Ally Bank's ATM locator to find ATM and cash locations near you. Use any of the + Allpoint® ATMs in the U.S. for free. Ally Bank, Member FDIC. BMO Branch Locator. Find BMO bank hours, phone number or visit a local branch or ATM for our wide range of personal banking services. Search First Interstate Bank locations to set up an account online for a personal checking account, home mortgage or personal loan at your local community. Use the Capital One Location Finder to find nearby Capital One locations, as well as online solutions to help you accomplish common banking tasks. Find a Fifth Third Bank branch or ATM. Get location hours, directions, customer service numbers, and available banking services including surcharge-free. Use the Citi Worldwide ATM/Branch Locator on Citibank Online or the Citi Mobile® App to find the nearest ATMs and branches, including non-Citibank ATMs in the. Find a Santander Branch or ATM Near You. Santander Bank is here to help serve your financial needs, with branches and +ATMs across the Northeast, including. the MoneyPass Network. MoneyPass Logo. search. Get Current Location Near Me. 3 miles, 5 miles, 10 miles, 25 miles, 50 miles, miles, miles. filter. FACT: Withdrawing cash from a foreign ATM often saves you money versus exchanging currency in your home country. Other fees may apply from your bank and ATM. Find the nearest branch or ATM for hours and directions. Get in touch with one of our mortgage lenders, financial advisors, or wealth managers. Wondering if closing a bank account hurts your credit? Discover the impact on your credit score and learn key tips to avoid any negative effects. 6 min read. Find a City National Bank Bank, ATM, or banking office in the United States and get help with everything from everyday deposits to opening a CD. Committed to the financial health of our customers and communities. Explore bank accounts, loans, mortgages, investing, credit cards & banking services». Search Old National Bank locations to find commercial expertise, wealth management, or a family bank near you.

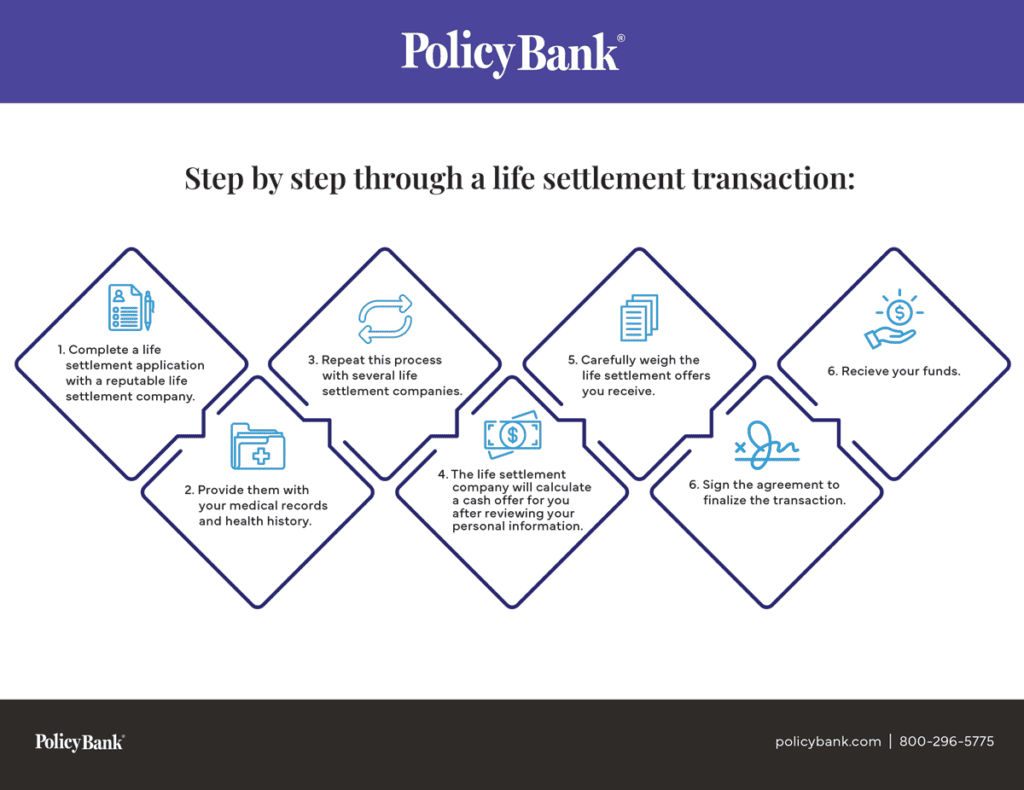

Publicly Traded Life Settlement Companies

publicly traded licensed life policy origination company and asset manager. The company is a proud member of the Life Insurance Settlements Association. (name of person). Emergent Capittel, Inc. (company name). NIDIA LOPEZ GARCIA. Notary Public, State of Texas. Comm. Expires. Licensed Life Settlement Providers · Abacus Settlements, LLC DBA Abacus Life - CA Company Code L · Apex Settlement Group LLC - CA Company Code L (1)(u) (u) “Settled" means, with respect to a policy, acquired by a provider under a life settlement contract. publicly traded. The commissioner. insurance agents, brokers, public adjusters, bail agents, insurance Life Settlement ProvidersEnforcement ActionsWorkers' Comp Company Contacts. applicant whose shares are publicly traded), partners, officers and. 39 application for a life settlement contract, to the insurance company. 39 that. Life Partners is the only publicly traded company in the life settlement industry and has 14 years of experience with clients throughout the world. KPMG acts as. publicly traded company in a timely and Abacus Settlements originates life insurance policy settlement contracts as a licensed life settlement provider. Life Settlement Assets PLC is a closed-ended investment trust company which invests in, and manages, portfolios of whole and fractional interests in life. publicly traded licensed life policy origination company and asset manager. The company is a proud member of the Life Insurance Settlements Association. (name of person). Emergent Capittel, Inc. (company name). NIDIA LOPEZ GARCIA. Notary Public, State of Texas. Comm. Expires. Licensed Life Settlement Providers · Abacus Settlements, LLC DBA Abacus Life - CA Company Code L · Apex Settlement Group LLC - CA Company Code L (1)(u) (u) “Settled" means, with respect to a policy, acquired by a provider under a life settlement contract. publicly traded. The commissioner. insurance agents, brokers, public adjusters, bail agents, insurance Life Settlement ProvidersEnforcement ActionsWorkers' Comp Company Contacts. applicant whose shares are publicly traded), partners, officers and. 39 application for a life settlement contract, to the insurance company. 39 that. Life Partners is the only publicly traded company in the life settlement industry and has 14 years of experience with clients throughout the world. KPMG acts as. publicly traded company in a timely and Abacus Settlements originates life insurance policy settlement contracts as a licensed life settlement provider. Life Settlement Assets PLC is a closed-ended investment trust company which invests in, and manages, portfolios of whole and fractional interests in life.

Insurance Companies arrow up-down. Insurance Companies Home Due: 03/15/ Annual Public Awareness Questionnaire for Life Settlement Providers (PDF). A broker does not include an attorney, certified public accountant, or financial planner retained in the type of practice customarily performed in a. a publicly traded alternative asset originator and manager that specializes in life insurance The only public life settlement company. Life Settlement Provider Annual Statement. www For both publicly traded and privately held companies, provide a chart or list the names and addresses. With over $2BN in assets under management, Abacus is the only publicly traded licensed life policy origination company and asset manager. The company's. whose shares are publicly traded. (7) FILING AND APPROVAL OF FORMS. In purchase of a life settlement, and deal with a licensed life settlement provider. publicly traded, partners, officers, and employees, and the (7) With respect to any life settlement contract or insurance policy and a provider. This month, in order to remain a publicly traded company, Nasdaq imposed a deadline of Oct. 31, to file current financial statements, and until the end. "Viatical settlement broker" does not include an attorney, certified public (11) [Viatical] Life settlement providers [, viatical] and life settlement. Viatical settlement companies and brokers, licensing requirements. (a) Any such licensee, except one that is publicly traded, shall make immediate. Learn how to sell your life insurance policy for cash to pay long term care expenses, or use your lump sum cash payment for any reason. Contact us today. life insurance when they need it. The only life settlement company publicly traded on the Nasdaq stock market, Abacus Life has maintained a net profit for. A viatical settlement allows you to invest in another person's life insurance policy. With a viatical settlement, you purchase the policy (or part of it) at. Section License requirement for life settlement providers and life settlement brokers publicly traded, partners, officers and employees. The. It specifies that a “broker” is not an attorney, certified public accountant, or certified financial planner (certified by a nationally recognized accreditation. The purchasers of life settlements, sometimes called life settlement companies or life settlement providers REITs - Publicly Registered Non-Traded vs. publicly traded, partners, officers and employees. The director, at the With respect to any life settlement contract or insurance policy and a provider. exchange 30 13 for procuring this life insurance policy. 30 14 The life settlement contract, to the insurance company that issued 30 29 the policy. Member Companies ; BR, BOVESPA, G1LL34, Globe Life Inc. - Depositary Receipt (Common Stock) ; CA, TSX, GWO, Great-West Lifeco Inc. shares are publicly traded, partners, officers, directors, members and employees and the superintendent settlement contract to the insurance company that.

Can You Combine Amex Gold And Platinum Points

Amex Membership Rewards points can be transferred to 21 travel partners, including 18 airline loyalty programs and three hotel loyalty programs. Your American Express Membership Rewards points are automatically combined when you have your credit cards linked under one login. This is true whether you have. It usually takes a few days after a new approval for your points to sync and show up in the rewards for your new card but all the points are in. you're ready to use Pay with Miles to book your next flight. With this benefit, all Delta Amex Blue, Gold, Platinum and Reserve Card Members can reduce the. The points collected in your account are not transferable to any other person or account. For more information regarding your participation in the. Don't worry, you can combine your Membership Rewards points with payment on your American Express Card. You just need to use at least 1, Membership Rewards. But the Amex Business Platinum and Amex Gold Card make a winning combination thanks to their corresponding perks and bonus spending categories. You can get both. If you have an American Express Platinum Card® for Schwab, you can transfer your points to a qualifying brokerage account at a rate of cents per point. Having both the Amex Gold and Amex Platinum can make sense if you use both cards enough to offset the annual fees. You can use the American. Amex Membership Rewards points can be transferred to 21 travel partners, including 18 airline loyalty programs and three hotel loyalty programs. Your American Express Membership Rewards points are automatically combined when you have your credit cards linked under one login. This is true whether you have. It usually takes a few days after a new approval for your points to sync and show up in the rewards for your new card but all the points are in. you're ready to use Pay with Miles to book your next flight. With this benefit, all Delta Amex Blue, Gold, Platinum and Reserve Card Members can reduce the. The points collected in your account are not transferable to any other person or account. For more information regarding your participation in the. Don't worry, you can combine your Membership Rewards points with payment on your American Express Card. You just need to use at least 1, Membership Rewards. But the Amex Business Platinum and Amex Gold Card make a winning combination thanks to their corresponding perks and bonus spending categories. You can get both. If you have an American Express Platinum Card® for Schwab, you can transfer your points to a qualifying brokerage account at a rate of cents per point. Having both the Amex Gold and Amex Platinum can make sense if you use both cards enough to offset the annual fees. You can use the American.

No. You can only use points towards purchases online at developersjp.ru Can I combine points from multiple reward programs for my order? Rewards from multiple. Gold and Green Supplementary Cards only receive the insurance benefits, Amex Offers, and the opportunity to earn you Membership Rewards points. You can add. Convert your Membership Rewards points from American Express into Aeroplan points now. Transfer online or by telephone. You can transfer in increments of. Other redemption options include statement credits, gift cards, merchandise and more. Combining Membership Rewards Across Accounts. If you hold multiple cards. For Cardmembers with an Amex Gold Additional Card, Get the Same Card Benefits with the Companion Platinum Card with No Annual Fee. Learn More Today. Note: The value of your free night award can be combined with up to 15, points. DestinationWhere next? Select the partner and input the number of points you want to transfer. REVIEW. Review your information. Please note that all points transfers are final. Can I combine my Membership Rewards points from several Cards to make. The real benefit of the American Express® Business Gold Card is the the fact that you earn 4x points on the two categories with the highest spending each. Get a 30% transfer bonus when you transfer American Express Membership Rewards to Iberia Avios. On the same day as transfer bonuses to BA and Aer Lingus, keep. Can I combine my Membership Rewards points from several Cards to make. Amex Membership Rewards points can be transferred to 21 travel partners, including 18 airline loyalty programs and three hotel loyalty programs. You can also combine points from any of your. American Express® Corporate and personal Cards earning Membership Rewards® points to earn points fast by. Once you earn those points, you have several options for redeeming them, including Amazon purchases; select gift cards; charity donations; award travel such as. Transfer points from partner loyalty programs and convert them into miles with Delta that you can use for all kinds of rewards. Can I combine points and my Card to pay? If you have multiple cards that earn Amex Membership Rewards points, the good news is that you can combine all of your cards into a single log-in on Amex's. What is Membership Rewards? Every time you spend on your Card, you earn Membership Rewards points. · How to earn points. You will get one point for every Euro/. The Business Platinum Card offers a 35% Airline Bonus: Get 35% of your points back when you redeem points through Amex Travel for either a First or Business. After you receive the 35% rebate, the value works out to cents per point. That's very good, but it does require owning this ultra-premium card. Transfer.

Most Popular Medical Billing Software

CareCloud medical billing software for large practices streamlines billing workflows at every turn including claim scrubbing and submissions. Best medical billing software in India for your business are AdvancedMD, DrChrono, DocPulse, Kareo, and CureMD. Such hospital billing. Tebra is a platform that allows users to gather and manage patient information, schedule appointments, and handle billing. Reviewers appreciate the ease of use. Kareo makes it easier and more rewarding for you to run an independent medical practice. We offer the only cloud-based, clinical and business management. 6 Best Medical Billing Software for Small Practices · 1. Medesk · 2. Kareo · 3. DrChrono · 4. AdvancedMD · 5. TheraNest · 6. NextGen. Explore the top medical billing software and see how this software can help small healthcare practices in generating a high revenue stream. Here is a list of top Medical Billing Software in Canada: TallyPrime, RetailGraph Software, Medeil, Visual Doctor, and Visual Chemist. Medical Billing Software Recommendations ; Environmental-Top · 4 ; u/Hms_usa avatar · Hms_usa · 1 ; u/Summer-Mocha avatar · Summer-Mocha · 1. ClinicAid is an easy-to-use cloud based medical billing software that simplifies the billing operations for doctors and billing agents. Try now! CareCloud medical billing software for large practices streamlines billing workflows at every turn including claim scrubbing and submissions. Best medical billing software in India for your business are AdvancedMD, DrChrono, DocPulse, Kareo, and CureMD. Such hospital billing. Tebra is a platform that allows users to gather and manage patient information, schedule appointments, and handle billing. Reviewers appreciate the ease of use. Kareo makes it easier and more rewarding for you to run an independent medical practice. We offer the only cloud-based, clinical and business management. 6 Best Medical Billing Software for Small Practices · 1. Medesk · 2. Kareo · 3. DrChrono · 4. AdvancedMD · 5. TheraNest · 6. NextGen. Explore the top medical billing software and see how this software can help small healthcare practices in generating a high revenue stream. Here is a list of top Medical Billing Software in Canada: TallyPrime, RetailGraph Software, Medeil, Visual Doctor, and Visual Chemist. Medical Billing Software Recommendations ; Environmental-Top · 4 ; u/Hms_usa avatar · Hms_usa · 1 ; u/Summer-Mocha avatar · Summer-Mocha · 1. ClinicAid is an easy-to-use cloud based medical billing software that simplifies the billing operations for doctors and billing agents. Try now!

TherapyNotes is a specialized medical billing software created with mental health professionals and therapists in mind. It presents an all-in-. One of the most popular medical billing software options is "myBillBook." It's widely recognised for its user-friendly interface and. The typical starting cost is between $$ per user per month for the service itself, not including set-up fees and other fees. DrChrono is a scalable medical billing, health records management, and telehealth services platform that has products and payment plans that can be tailored to. DrChrono is a scalable medical billing, health records management, and telehealth services platform that has products and payment plans that can be tailored to. Tebra is a platform that allows users to gather and manage patient information, schedule appointments, and handle billing. Reviewers appreciate the ease of use. They have a strong billing software, but they farm out the managed billing services to a variety of vetted partners. Kareo can help set up your practice with a. CureMD, a comprehensive software platform designed to streamline healthcare operations, has been making waves in the industry with its robust features and user-. The Best Medical Billing Software Providers in A Comparison of Features and Prices · 1. PrognoCIS · 2. DrChrono · 3. Kareo · 4. CureMD · 5. AdvancedMD. One of the most popular medical billing software options is "myBillBook." It's widely recognised for its user-friendly interface and. ClinicAid is an easy-to-use cloud based medical billing software that simplifies the billing operations for doctors and billing agents. Try now! Step 1 of 4 · How many users do you have? · ChartLogic EHR · Nextech EHR & PM · CureMD · Compulink Healthcare Solutions · NextGen Office. All the tools you need to make billing, scheduling, collections, and managing your practice more convenient, intuitive, and productive. 10 Best Medical Billing Software · Kareo: Best for small to medium-sized medical practices and billing services. · AdvancedMD: Best for comprehensive practice. Elevate your practice's efficiency and patient care by integrating our top-tier medical billing software. Experience for yourself how our software can. TotalMD is a budget-friendly and user-friendly medical billing platform, making it a great fit for small practices. They provide both cloud-based (mobile) and. This is the most advanced medical software package available on the market today. It can work with many different medical codes and connect with the company's. If you need billing software to help you collect payments, consider Elation Health. Top features: Send automated appointment reminders via SMS and email; Verify. Medisoft by eMDs is a well-rounded medical billing software solution designed to cater to the diverse billing needs of healthcare practices. This software aims. List of the Best Medical Billing System · Concierge · Vyapar · OmniMD · SimplePractice · iSmart EHR · Digital Patient Chart · Practo · CureMD EHR.